I was born in São Paulo, Brazil, in 1992, into a middle-class family. I grew up with my grandparents while my parents worked long hours every day. My dad still leaves for work at 4:30 AM and returns around 9:30 or 10 PM. My mom had a similar schedule. They worked tirelessly to ensure we never lacked anything at home, supporting both my grandparents and my younger brother, born just a year after me.

The year I was born, Brazil was going through political turmoil, with the president facing impeachment and inflation spiraling out of control. An uncertain economic environment has persisted in Brazil ever since. My parents, like many, lived paycheck to paycheck and, like me, weren’t exposed to financial education either at school or elsewhere.

Despite that, they made sacrifices to send us to private schools and even a great university. I began my Civil Engineering degree in 2010, graduating in 2015, and went on to complete a postgraduate degree in Geotechnical Engineering in 2017—this one financed by my own salary. I’ve been working for the same international company since 2011, and they offer a solid career path.

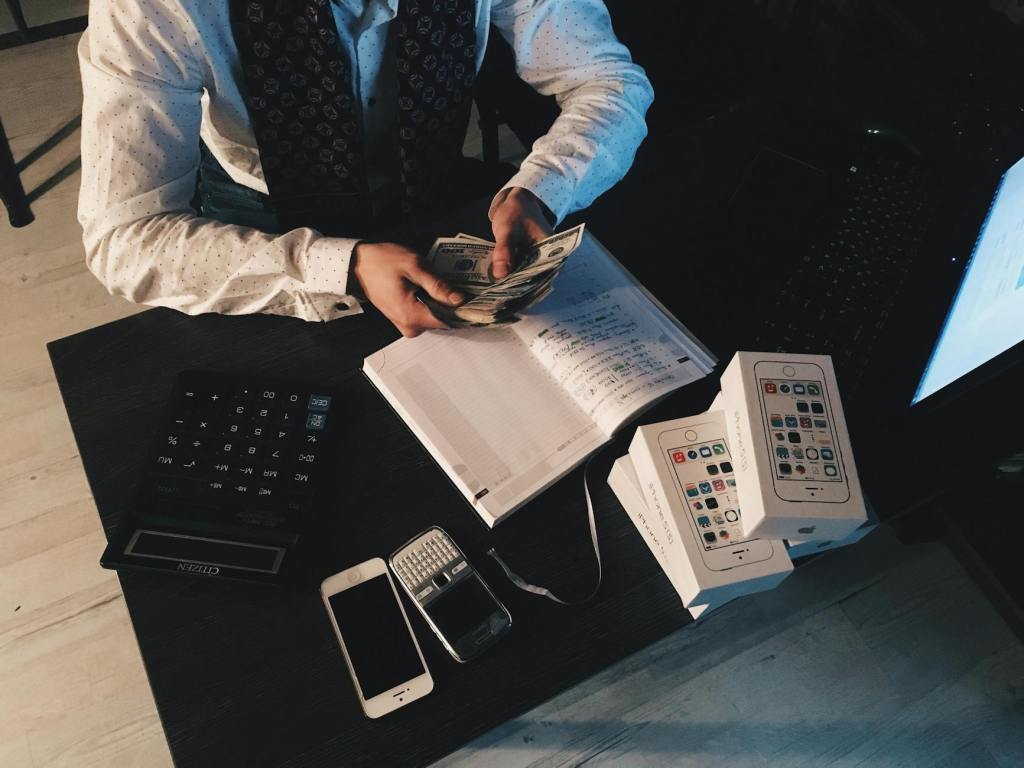

But despite my professional success, I found myself in a similar financial pattern as my parents—burdened by loans, car payments, and consortia (which, by the way, I think that doesn’t even exist in the U.S.). Even with an above-average salary, I constantly struggled with a shortage of money by the end of the month.

In 2022, I met my now-wife, and she changed my life completely. She introduced me to Jesus, and through Him, I finally started to see changes in every area of my life, including my finances. I’ve experienced so many miracles, which is a story for another day.

At the start of 2023, I began paying off my debt, which totaled around R$180,000 (roughly $34,000). I sold a real estate consórcio, reducing the debt to R$120,000 ($22,000), and started aggressively paying down the loans. I even sold my car and began using my parents’ car. During this time, I proposed to my wife, which added a new financial challenge, but thankfully, we were able to pay for the wedding without missing any loan payments.

Earlier this year, I was offered a job transfer to the United States. This allowed me to cash out my workers fund. With that money, we cleared all remaining debt in Brazil and had about $13,000 left over. However, moving to the U.S. turned out to be more expensive than we expected, and combined with settling into a new country, we spent all of that money, leaving us with no savings, but also no debt.

I’ve recently started watching a lot of videos by Ramit Sethi and others, and am now working on organizing our financial life here. My goal is to save as much as possible while we adjust to life in the U.S. I will try to read again Rich Dad, Poor Dad too.

For now, I’m the only one working here in the States, as my wife, who is also an engineer, is focusing on managing our home.

Through this blog, I want to share my monthly expenses and investments as a way to keep track of my progress, inspire others, and hopefully get some tips from readers along the way to my financial freedom/retirement.

In my next post, I’ll share our current financial situation.

Leave a reply to Julia Cancel reply